Personalising Tax Receipts

The platform automatically generates a PDF donation tax receipt for all transactions. This includes registration fees, donations, shop payments etc. Receipts will adopt the settings applied at Platform level, but can be further customised for events, charities or pages.

In the article learn about:

Platform Level

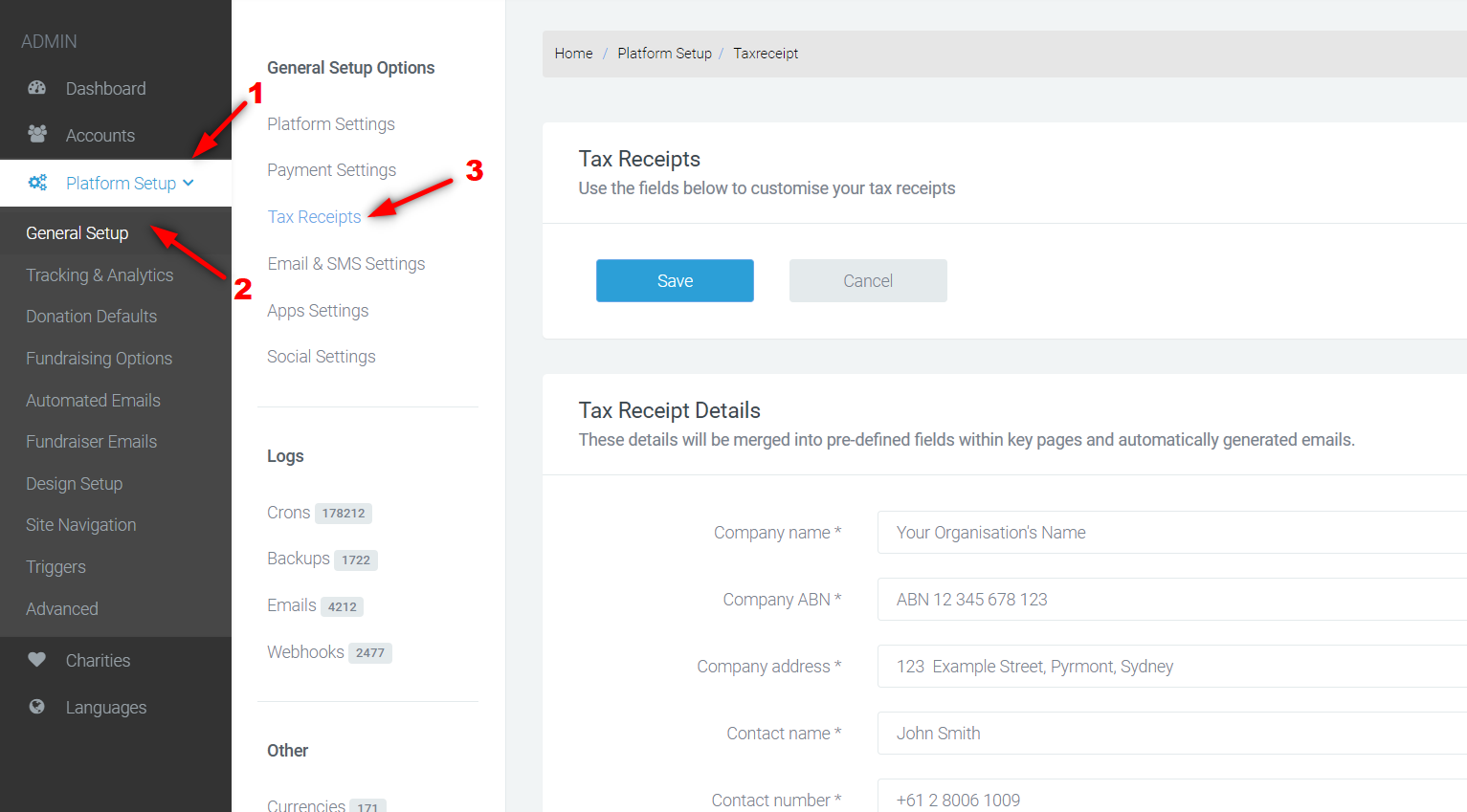

Tax receipts can be customised at platform level to set up the site default receipt options. To edit tax receipts at platform level, navigate to:

Platform setup > General Setup > Tax receipts (white middle navigation)

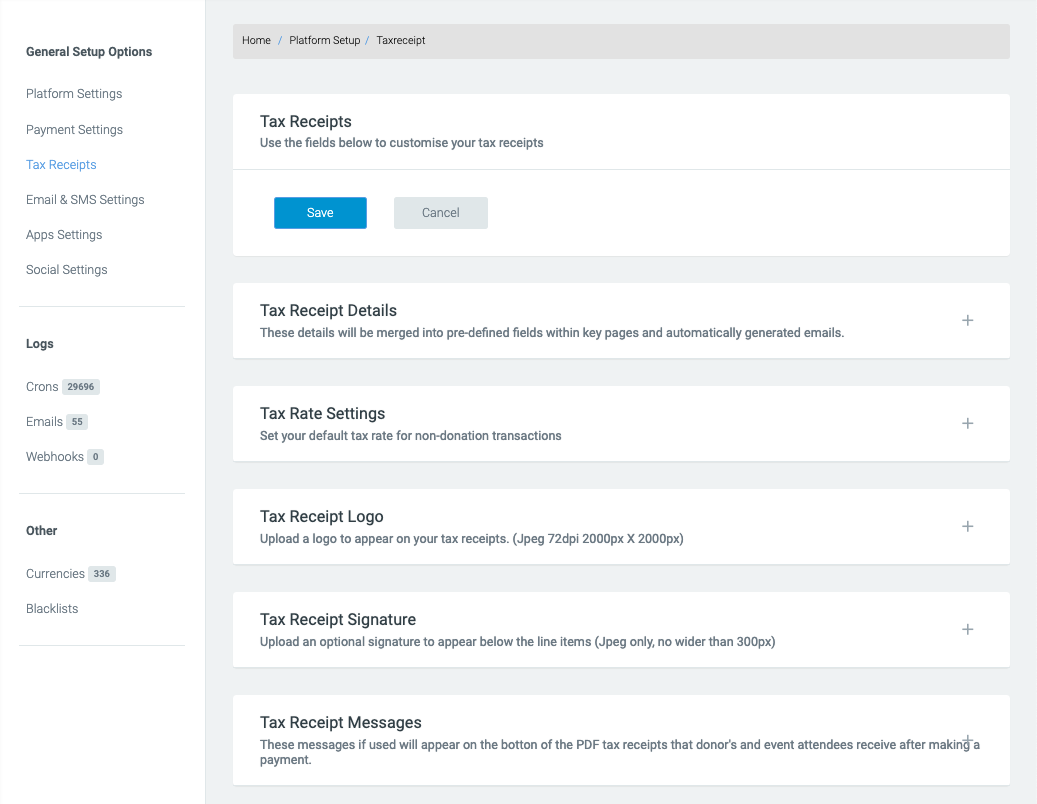

- Tax Receipt Details

- Tax Rate Settings

- Tax Receipt Logo

- Tax Receipt Signiture

- Tax Receipt Messages

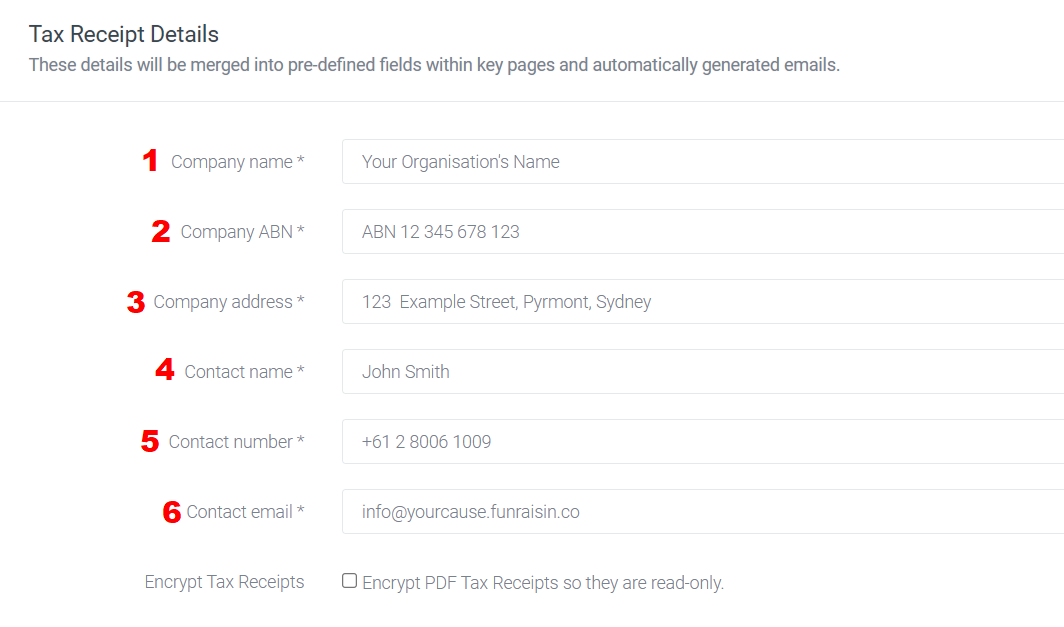

Tax Receipt Details

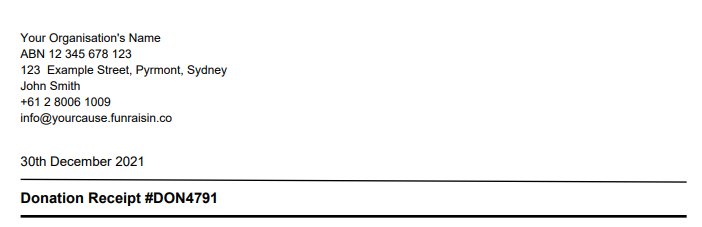

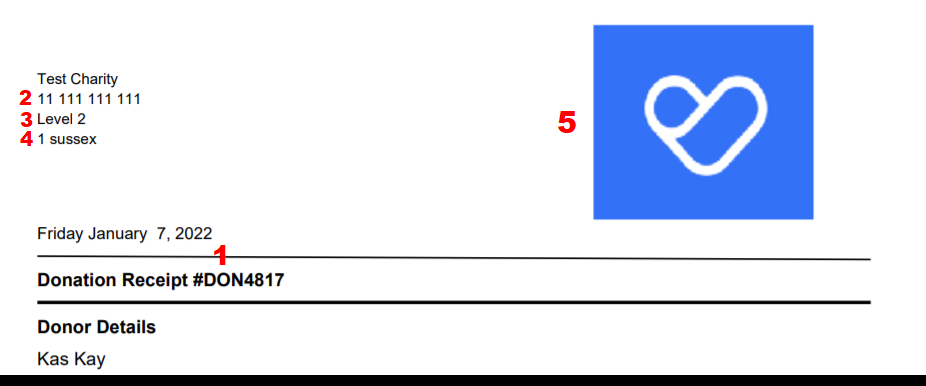

This section is for adding tax invoice details that appear in the top left corner of receipts.

- Company name

- Company ABN (Australian Business Number, can be any business number or reference)

- Company address

- Contact name

- Contact number

- Contact email address

These details will appear in the same order as listed above. This is the case unless tax receipt details get overridden at the event or page level.

The below screenshots show how the inputted details will show on a receipt. The date will automatically pull in and display.

Tip: If you don’t want a field to show, leave it blank. Or, if you want two email addresses to display and no phone number, simply use the Contact number field for a second email address.

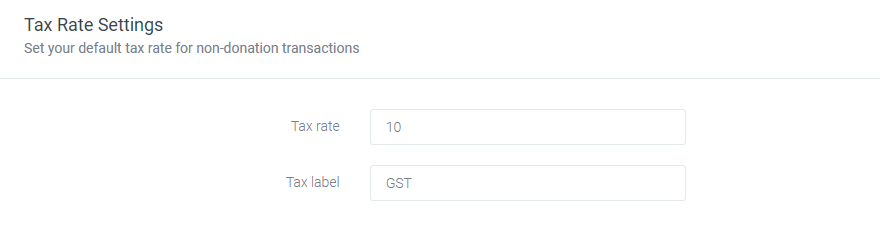

Tax Rate Settings

We set the tax rate based on the platform location. The tax applies to non-donation transactions. Here is an example of an Australian site:

This can be changed to any value and label you need. So for the UK, this could be changed to 20, and VAT.

The tax rate will be included in the total price, and not added on top. For example, if your reg fee is $10, the 10% tax (which is $0.90) is included in $10, then this will display the tax as $0.90.

Tax Receipt Logo

A logo can be uploaded here and it will be displayed at the top right hand corner of the tax receipt. For it to display, make sure the logo image file is in JPEG format, in rectangular shape with the dimension of 2000px by 2000px.

PNG will not display.

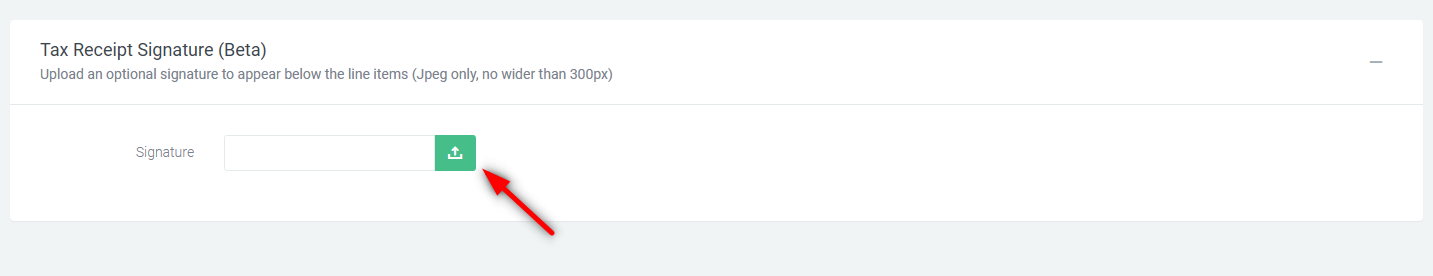

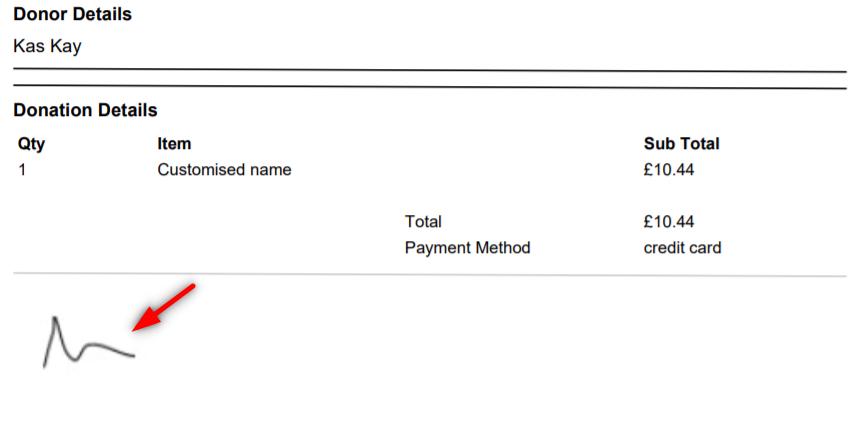

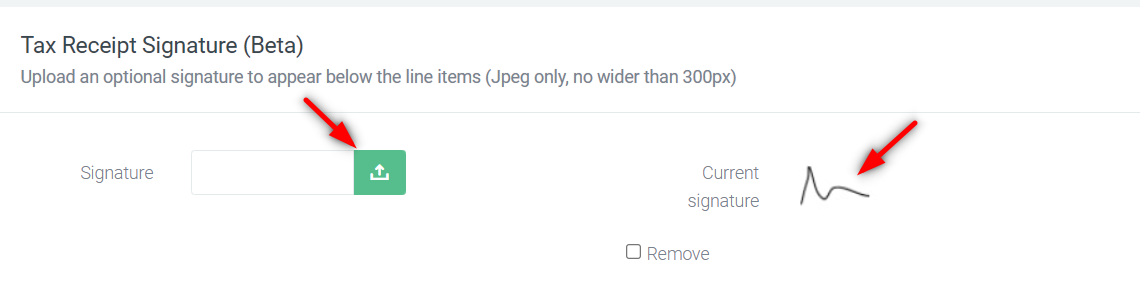

Tax Receipt Signature

A signature can be uploaded here and it will be displayed below the line items at the very bottom of the tax receipt.

Please note: Make sure your signature file is in JPEG format and no wider than 300px.

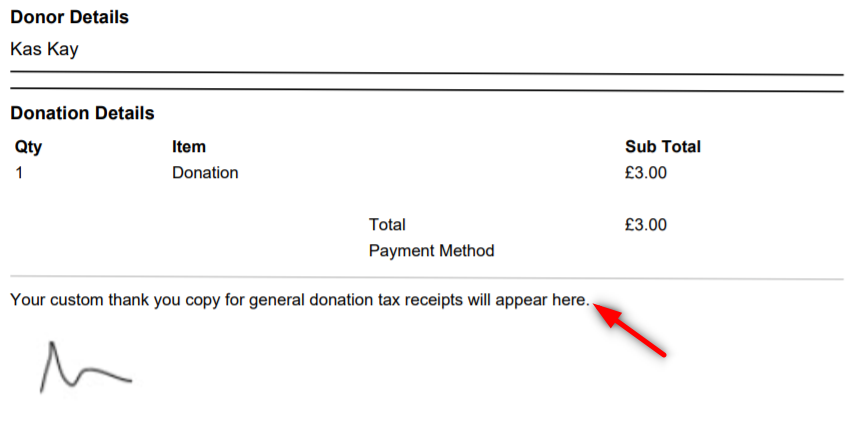

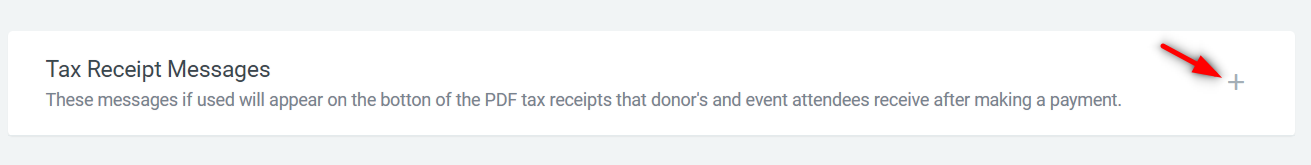

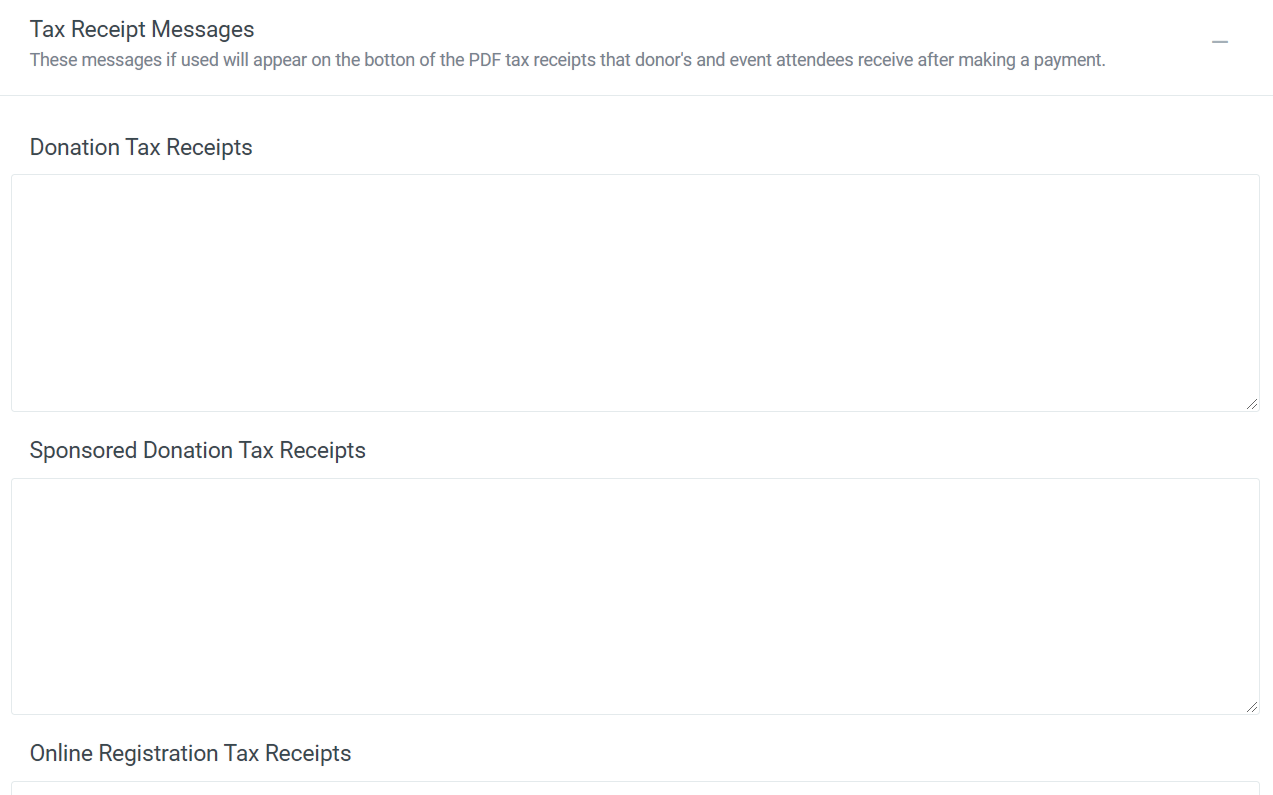

Tax Receipt Messages

A message can be displayed at the bottom of the PDF donation tax receipt. This can be useful if you would like to add a thank you message or any additional information to your tax receipts. There are seven different boxes for messages. Depending on the transaction type the relevant messages will be added to the receipt.

- Donation Tax Receipts: This message will be added to donation tax receipts which have been received on general donation pages.

- Sponsored Donation Tax Receipts: This message will be added to the donation tax receipts which have sponsored fundraiser pages.

- Offline Event Tax Receipts: This message will be added to donation and registration tax receipts for all offline events across the platform, unless overridden at the event or page level.

- Online Event Tax Receipts: This message will be added to donation and registration tax receipts for all online events across the platform, unless overridden at the event or page level.

- Shop Tax Receipts: This message will be added at the bottom of tax receipts for shop purchases.

- Raffle Tax Receipts: This message will be added at the bottom of raffle ticket receipts.

- EFT Invoices: This message will be added at the bottom of the EFT invoices which is generated after making a donation using electronic fund transfer.

Event Level

Tax receipts can be customised within an event for both donations as well as registration fee payments. Tax receipt setting in this section will be only applied to the event and will override customisation done at platform level. However, if the event is assigned to a charity the charity-level tax receipt setting will be applied rather than the event setting.

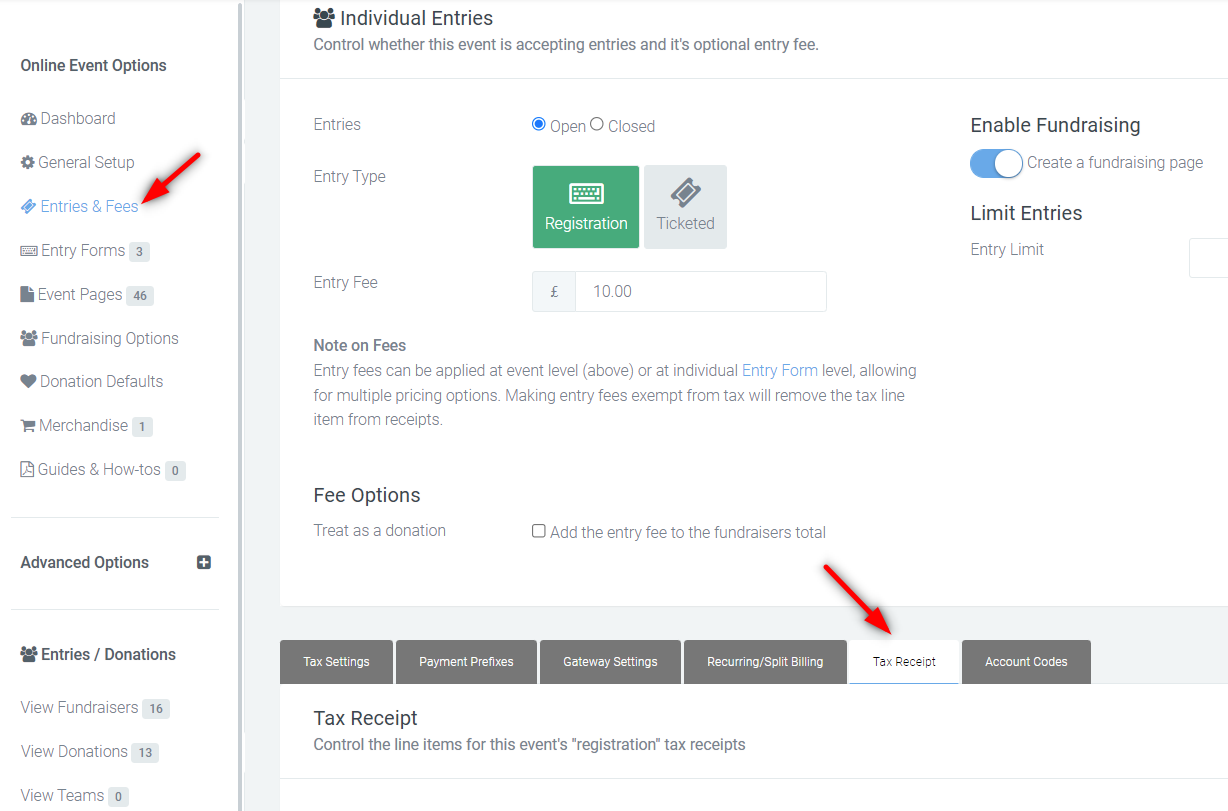

To edit tax receipt settings for an event (online, offline or DIY), edit the event. Navigate to:

Entries & Fees > Scroll down to the second set of tabs on the page > Tax Receipt tab.

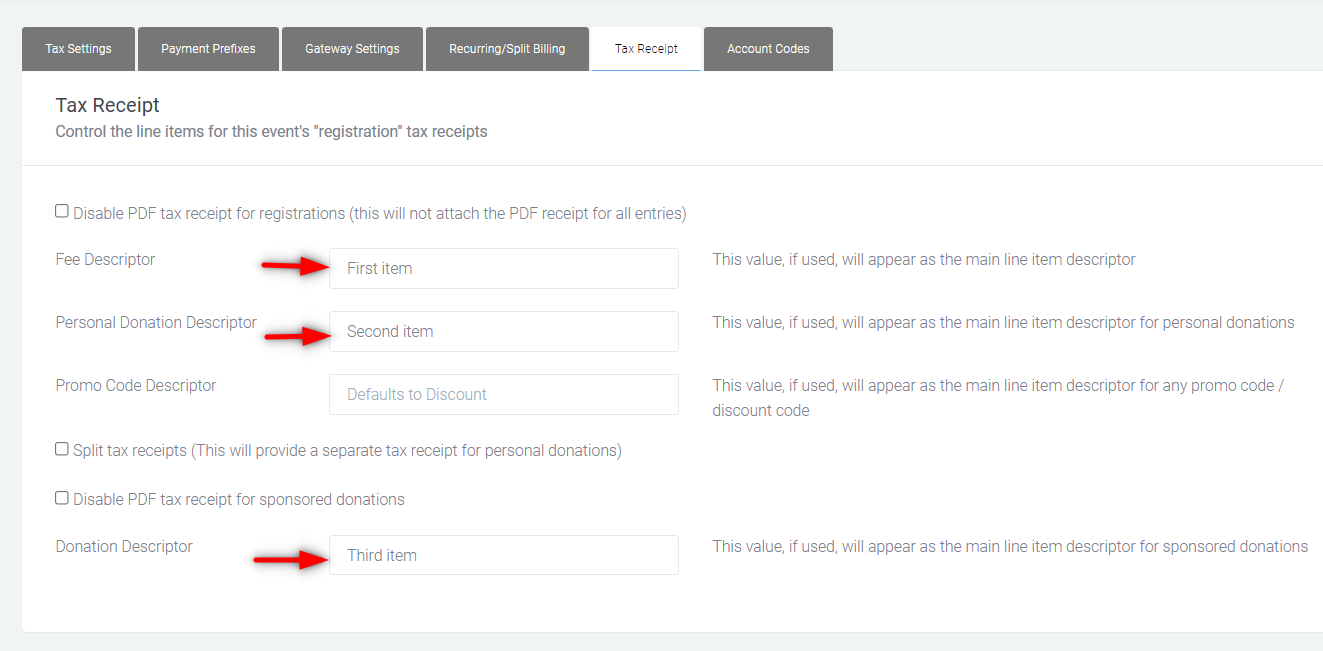

Tax Receipt

In this section, tax receipts can be customised.

- If the Disable PDF tax receipt for registrations option is checked, it won’t attach the PDF registration receipt to the registration email.

- Fee Descriptor: The value in this field will appear as the item name of the registration fee payment. If no value is added here, the text will be defaulted to the Registration Fee.

- Personal Donation Descriptor: The value in this field will appear as the item name of the personal donation payment made during registration. If no value is added here, the text will be defaulted to Personal Donation.

- Split tax receipts: If this checkbox is ticked, a separate tax receipt will be issued for personal donations made during registration. So you would receive one receipt for your entry fee and one for your donation.

- Similar to tax receipt for registrations, if the disable PDF tax receipt for sponsored donations is ticked it won’t attach a PDF tax receipt to the registration email.

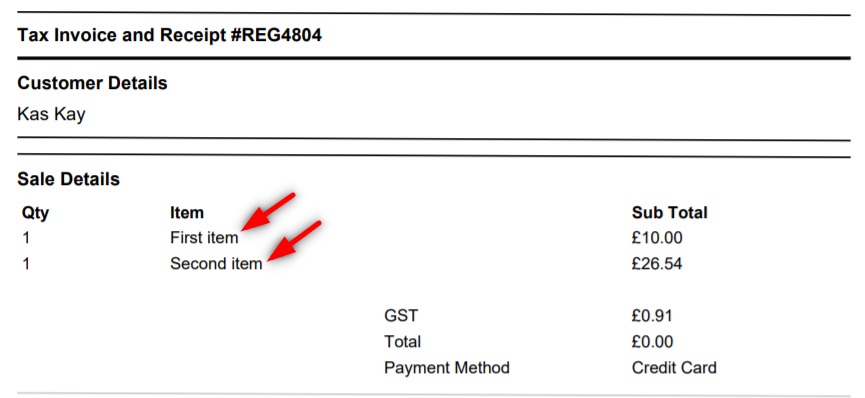

Below is an example of registration fee and personal donation in one tax receipt having been renamed..

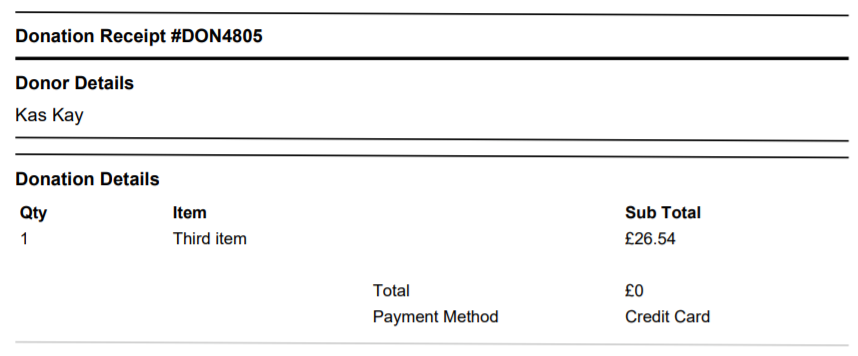

Below is an example of a personal donation in a separate tax receipt:

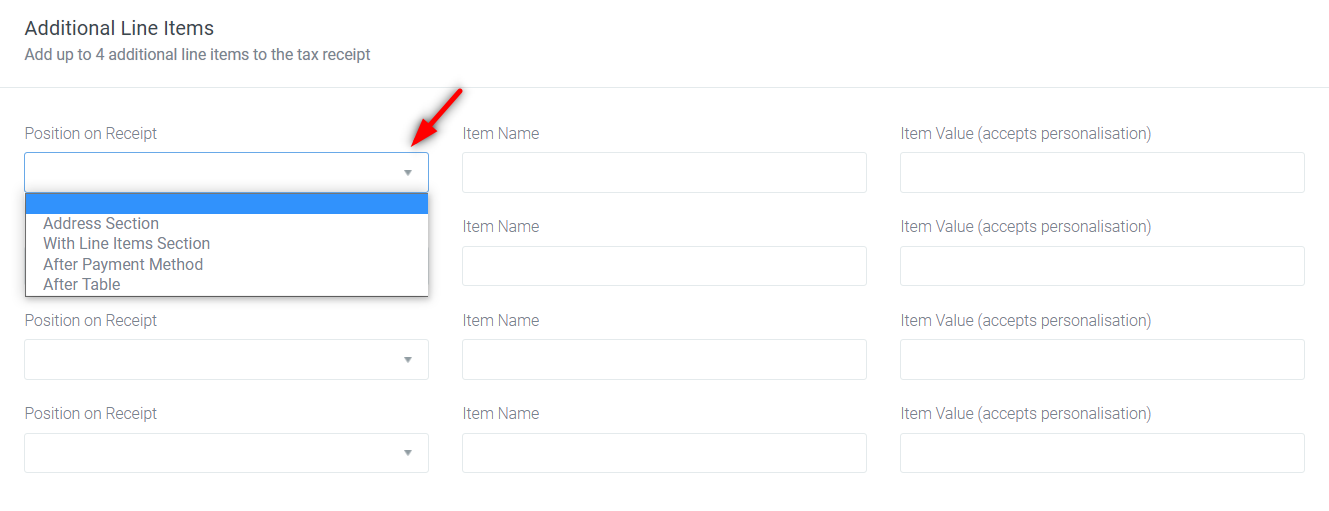

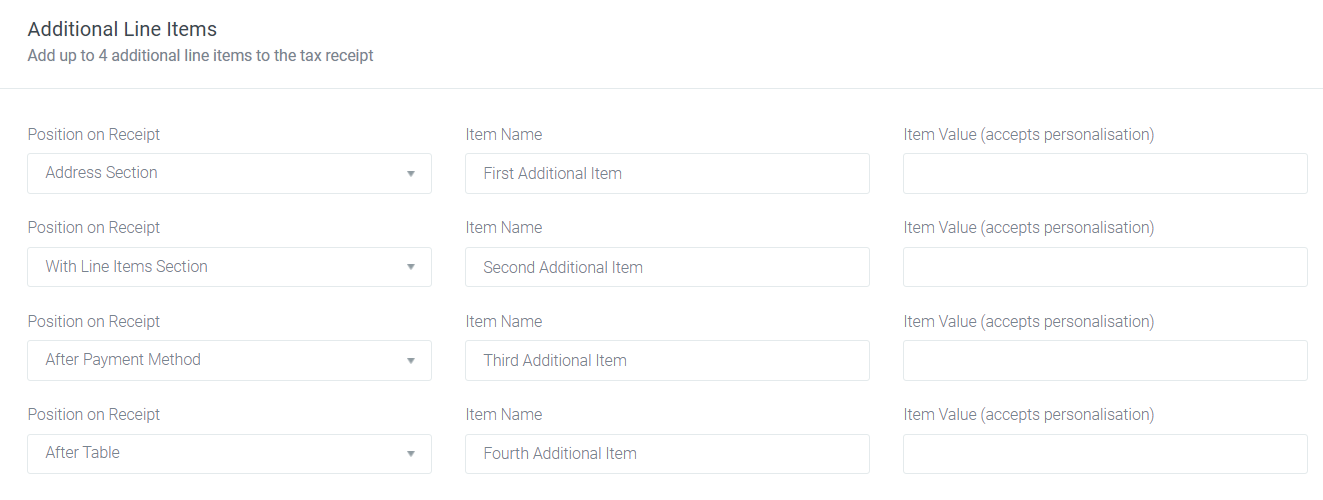

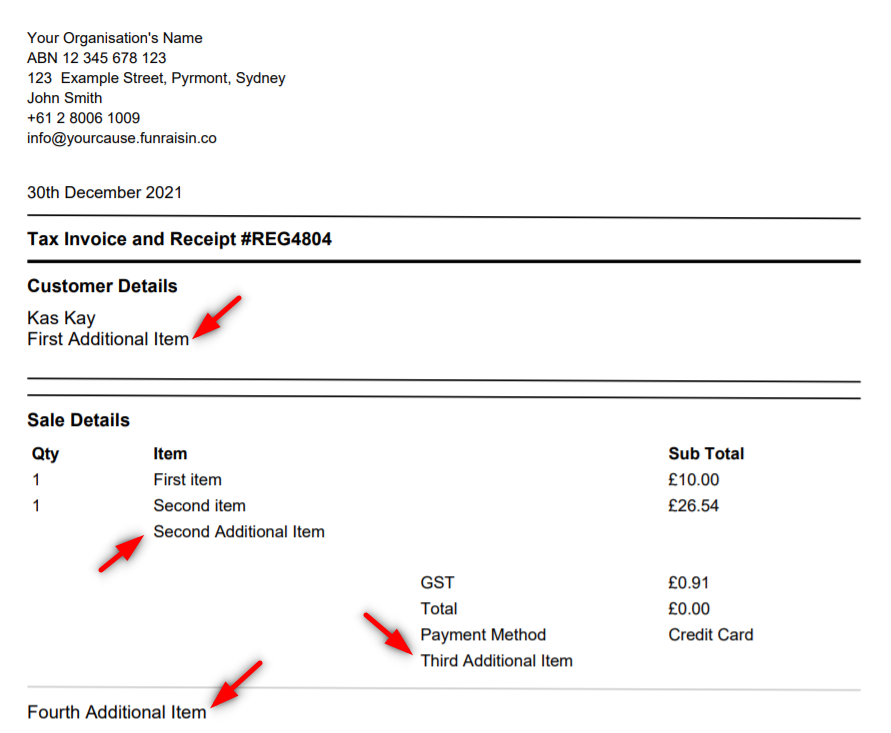

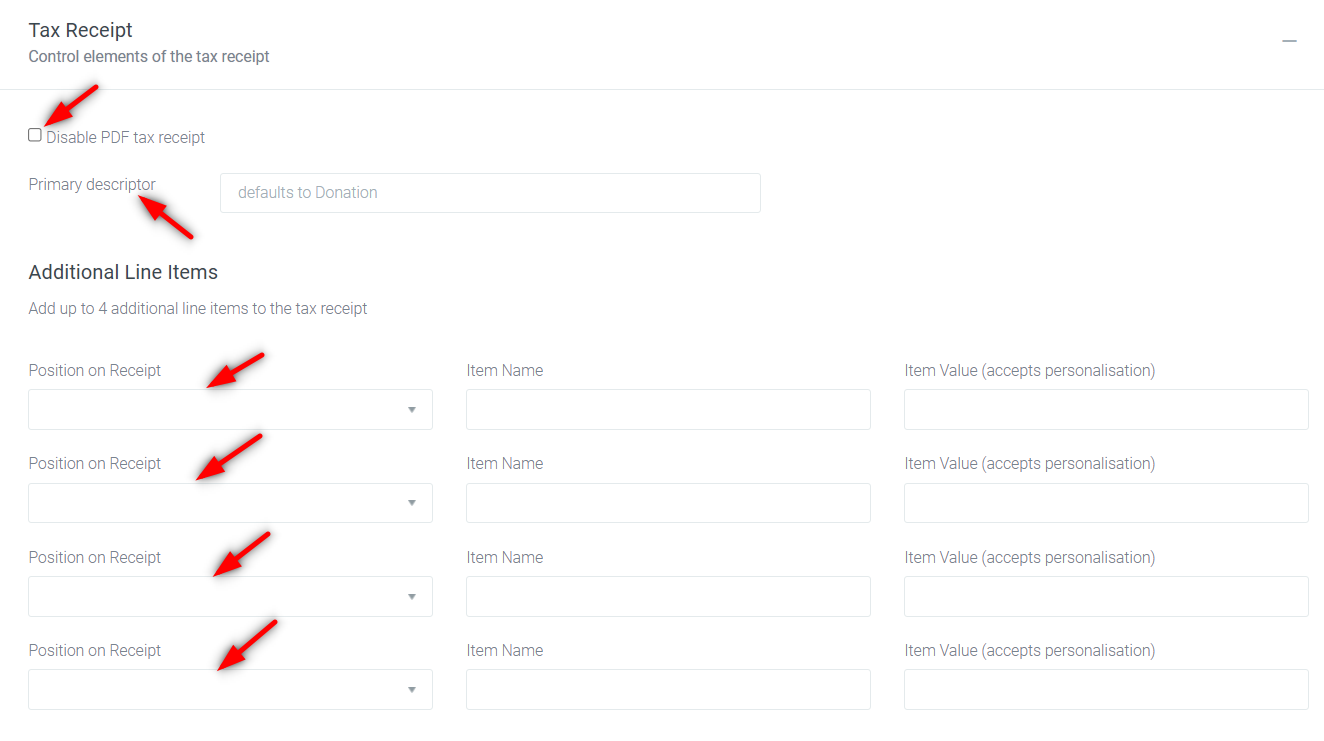

Additional Line Items

Four additional line items can be added to tax receipts in this section. They can be added in four different sections of the tax receipt based on the item selected from the Position on Receipt drop-down menu.

The following example demonstrates where the additional line items appear on a tax receipt:

Page Level

Tax receipts can be customised at the page level for donation pages as well as crowdfunding pages. Any settings on the page, will override the event level and/or platform level tax receipt settings.

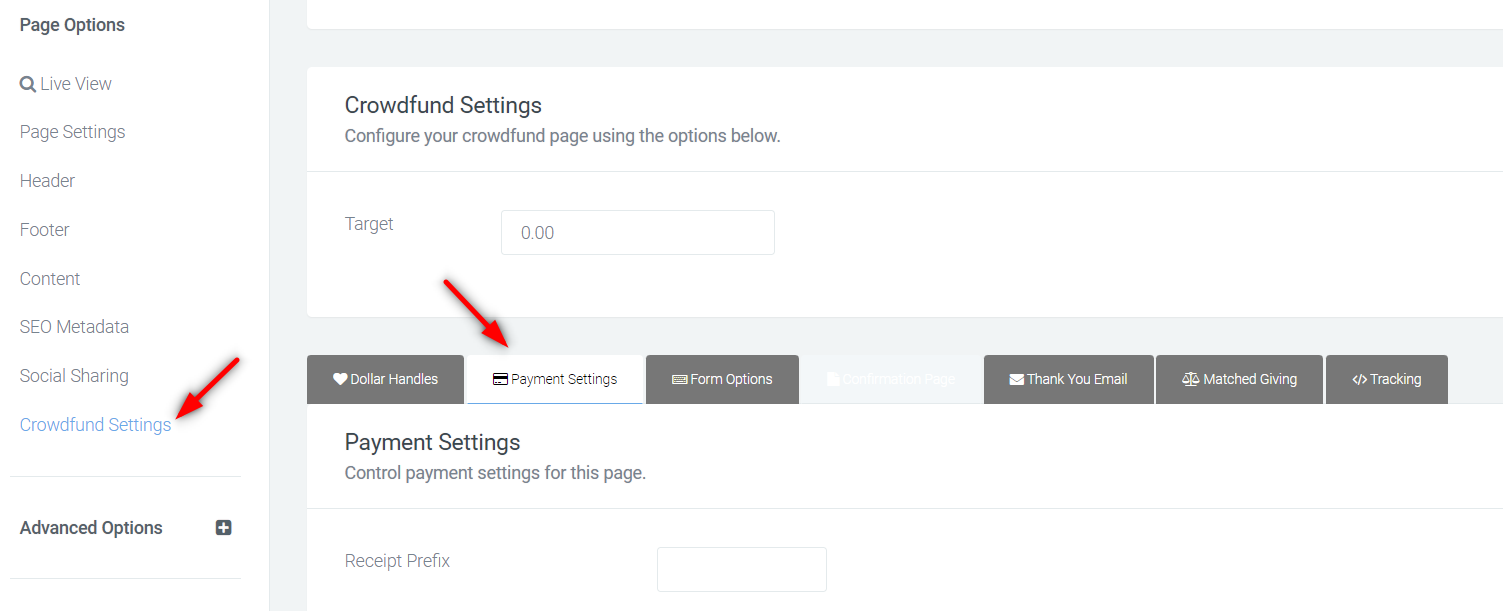

To edit the tax receipt for a donation page or a crowdfunding page, edit the page.

If using Classic Builder, from the middle navigation menu, click the Donation Settings (for donation pages) or Crowdfund Settings (for crowdfunding pages) > Payment Settings tab > Scroll down to the Tax Receipt section.

If using Visual Builder, edit the Donation block > Edit Donation Settings > Payment

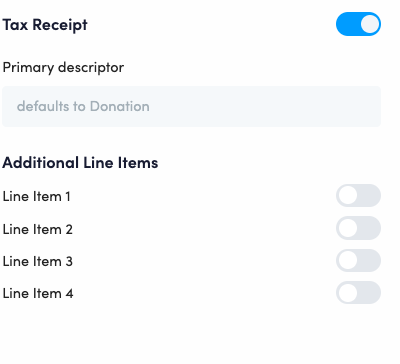

If you check the "Disable Tax Receipt option tax receipts won’t be generated for the donations received on the page.

The primary descriptor is an optional item name that can be added here and it will be displayed on the tax receipt. If no Primary descriptor is entered, the item name will default to Donation.

Similar to the event level, additional line items can be added to the donation tax receipts.

These settings have been shown in the image below:

This can also be accessed in Visual Builder, if you click on the little heart on the donation form, you can access the Tax receipt settings:

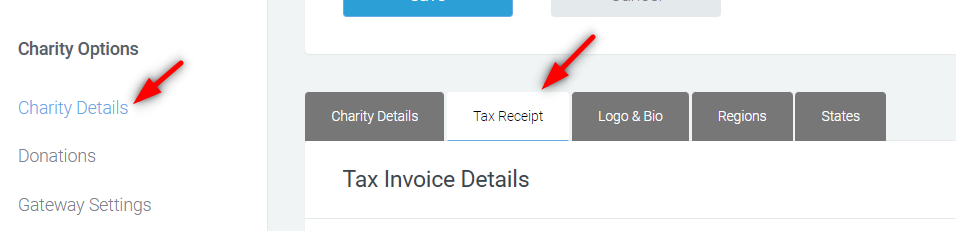

Charity Level

Tax receipts can be customised at charity level (only for multi charity sites). Charity level settings, will override the platform level tax receipt settings.

To edit tax invoices for a charity, navigate to:

Charities > Charity name > Tax Receipt tab

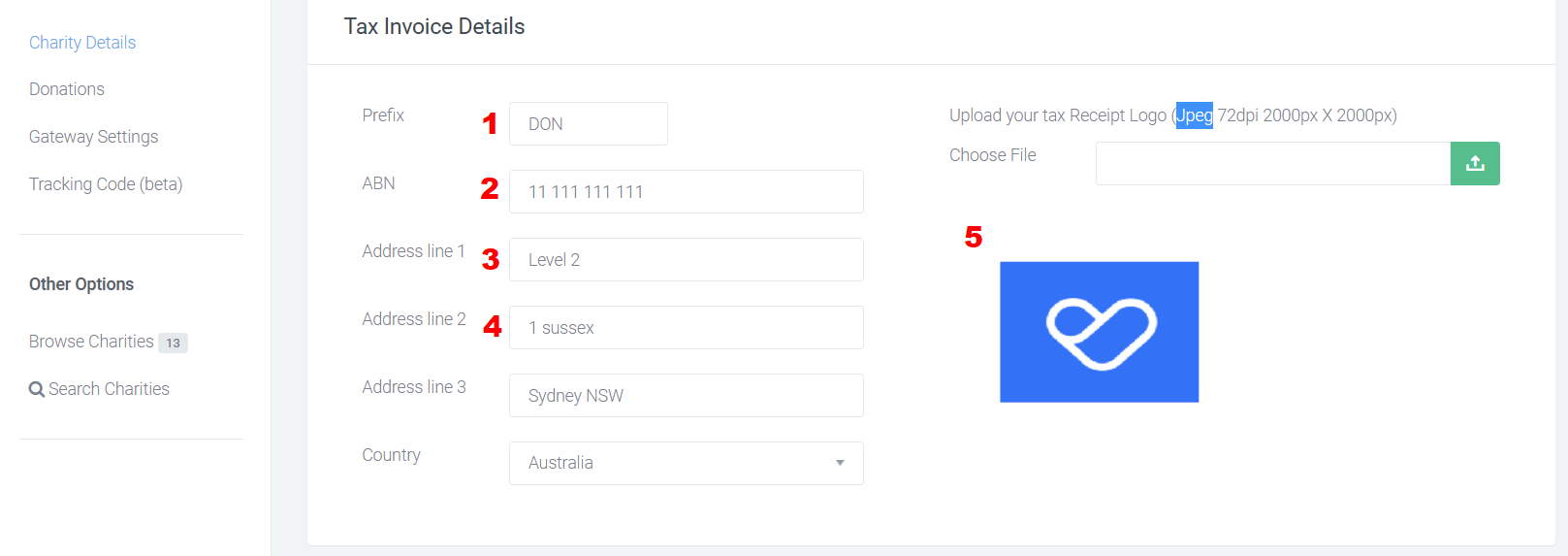

Tax Invoice Details:

- Prefix: The prefix can be added here and it will be displayed at the beginning of the donation receipt #

- ABN: It will be displayed at the top left corner of the tax receipt as the second item.

- Address line 1 and Address line 2: They will be displayed at the top left corner of the tax receipt as the second and third items respectively.

- A tax receipt logo can be uploaded by using the uploader. The uploaded logo will appear at the top right corner of the tax receipt. Prior to uploading the logo, ensure it is in JPEG format with 72dpi and dimension of 2000px by 2000px.

Below is an example of how it will look like on the Tax Receipt:

Tax Receipt Messages:

Similar to platform level tax receipt settings, if a message is added here, it will appear on the very bottom of the PDF donation tax receipt. Click on + to expand the message section

- Donation Tax Receipts: This message will be added to donation tax receipts which have been received on general donation pages.

- Sponsored Donation Tax Receipts: This message will be added to the donation tax receipts which have been on sponsored donation pages.

- Online Registration Tax Receipts: This message will be added to the donation tax receipts which have been on sponsored donation pages.

Tax Receipt Signature (Beta):

Similar to the signature setting at the platform level, a signature can be uploaded here and it will appear below the line items at the very bottom of the tax receipt.

That’s how the receipts can be edited at the platform level, event level, page level and charity level. To recap, page level tax receipt settings will override the event level settings and the event level setting will override the platform level one. On the other hand, for multi charity sites, charity level tax receipt settings overrides the platform level settings.

If you’d like further help please pop in a support ticket from your Funraisin admin and our team will assist you.