Gift Aid

Enable Gift Aid on your UK-based platform to claim an additional 25p for every £1 donated.

Gift aid is a UK tax incentive scheme that allows registered charities to claim 25p for every £1 made in donations.

This means charities can potentially gain an additional 25% in donations if they have the right tools in place to collect the data necessary for Gift Aid.

Below is an example of the Gift Aid declaration on a donation form.

This article will cover:

Claiming Gift Aid

For individuals to make a Gift Aid eligible donation, they must tick a box to confirm they are a UK taxpayer and provide their address when donating. If a donor ticks to make their donation Gift Aid eligible but does not provide a valid address, then Gift Aid cannot be claimed.

Therefore, it’s essential that the address fields on donation forms are mandatory so that donors' addresses are captured.

UK charities have two options regarding claiming Gift Aid from HMRC.

- Create custom Gift Aid donation reports on their platform and manage their claims off the platform.

- Chat to the UK team about our new Gift Aid claim integration where we can manage the claim process for you. More information can be viewed here.

Enabling Gift Aid

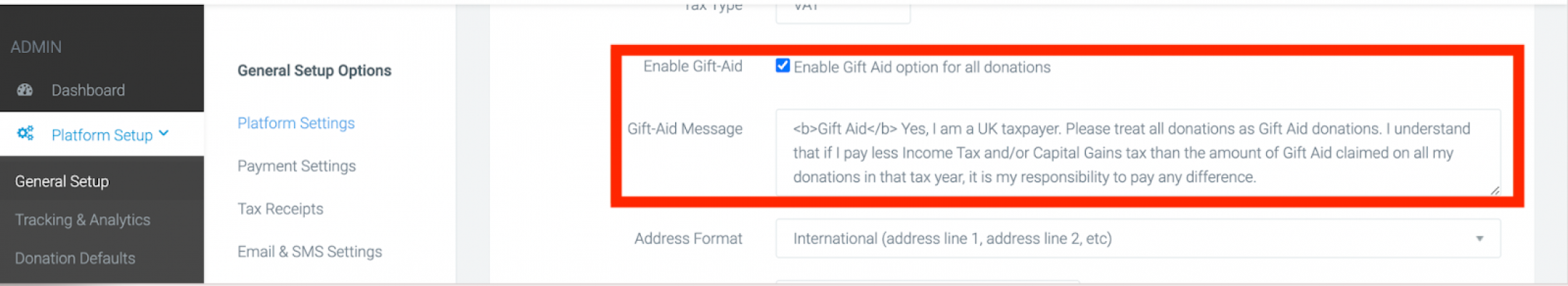

To enable Gift Aid and update the message a donor sees, navigate to

Platform Setup > Platform Settings > scroll down to the Gift Aid section.

Here gift aid can be enabled, along with setting the gift aid message:

Adding an address to Donation Pages

Classic Builder:

To do this navigate to the donation page and select:

Donation settings > Form Options.

Within the Address Details, ensure you tick the two below options. Save and Publish.

Visual Builder:

To edit in Visual Builder, edit your Donation block.

Edit Donation Settings > Form > Expand Personal Details > Display address and make mandatory > Save and publish

Adding an address to the Registration flow

If you have an optional donation option within your reg form, then you need to ensure you are capturing the entrant's address.

This can be done in the event:

Entry Forms > Edit your reg form > Create Account

Tick to display address and for it to be mandatory.

Adding an address to Sponsored donations

This can be set at Platform level or event level. To update at Platform level, navigate to:

Platform Settings > Donation Defaults > Sponsored Donations > Form Options

Ensure the address is ticked as a mandatory field for both Individual Pages and Team Pages, then Save.

To update at event level (necessary if you have custom donation amounts at event level), navigate to your event:

Donation Defaults > Form Options > Individual Pages / Team Pages

Ensure address is ticked as a mandatory field for both individuals and team fundraising pages and Save.

Reporting on Gift Aid

You can report on Gift Aid within your Donation reports. This will appear as a Y or N.

Navigate to your Data Exports module and edit any of your Donation reports. Within Export Fields add a new field, choosing ‘Gift Aid’ from the drop down.

You can also add a Smart List filter to a donation report to only pull donations that have opted into Gift Aid. To do this, navigate to:

Donations module > Search

site_url/management/donations/search

Expand Donor Details and tick 'opted into gift aid' > Save. Once done, this will display only donations that have opted into Gift Aid. At the top of the page, name this search, e.g. 'Gift Aid Donations' and save. This will create a smart list, that will keep updating with donations that match that criteria.

Now navigate over to your Data Exports module and edit your donation report. Within your filter options you can choose your new Gift Aid list and save. If you download the report, it will now only download the donations that have opted into Gift Aid. When using a smart list, you cannot use the event/page filter, on the report, but you can filter by date.

More information on claiming Gift Aid can be found on the UK Government website.

If you’d like further help, please pop in a support ticket from your Funraisin admin, and our team will assist you.