Assigning a receipt number to an offline donation

Find out the reason why an offline donation might not have a tax receipt number and generate a receipt number for it.

Offline Donations are considered donations that have been given directly to fundraisers or the charity and not made on a personal fundraising page or donation page. Similar to online donations a tax receipt number should be assigned to offline donations.

Key terms:

Pledged: A promise or agreement (from the donor) to make the payment in the future.

Receipt Number: A unique number assigned to each transaction on the platform (such as donations, entry fees, payments made to buy merchandise and etc).

This support article will explain why an offline donation may not have a receipt number and how to update it. For information on how to add an offline donation, please review this support article.

When an offline donation doesn’t have a receipt number, this means the offline donation has not been processed when this was set up.

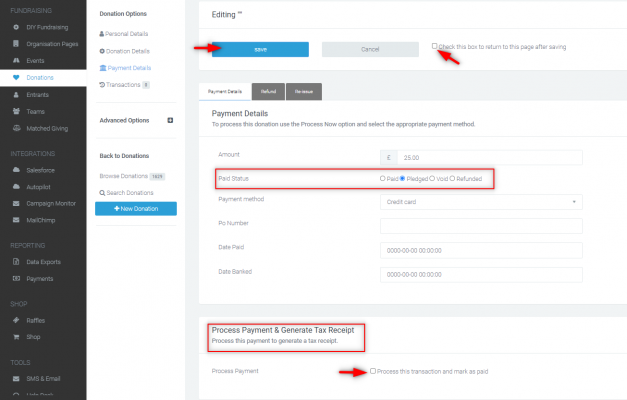

To process an existing offline donation, go to the donation record to edit it. The record will show Editing “” since it doesn’t have a receipt number. Click on Payment Details in the left hand nav and refer to the Paid Status.

If the status was set to Pledged, scroll down to the section Process Payment & Generate Tax Receipt and tick the checkbox to process payment. Before hitting the Save button, we suggest ticking the checkbox beside the Cancel button to return to the page after saving.

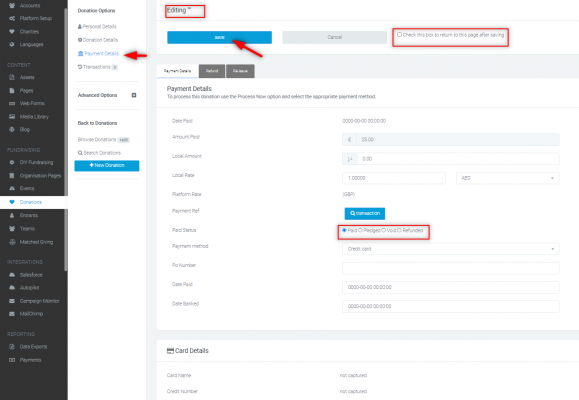

If the status was set to Paid, the checkbox to process the payment is not displayed, so change the Paid Status to Pledged first and make sure to tick the checkbox to return to this page, then hit save.

Once saved, follow the same steps above when status was set to Pledged. As soon as an offline donation is processed, a receipt number will then be generated, and the top of the page will read as Editing “{receipt number}.”

If you’d like further help, please pop in a support ticket from your Funraisin admin, and our team will assist you.